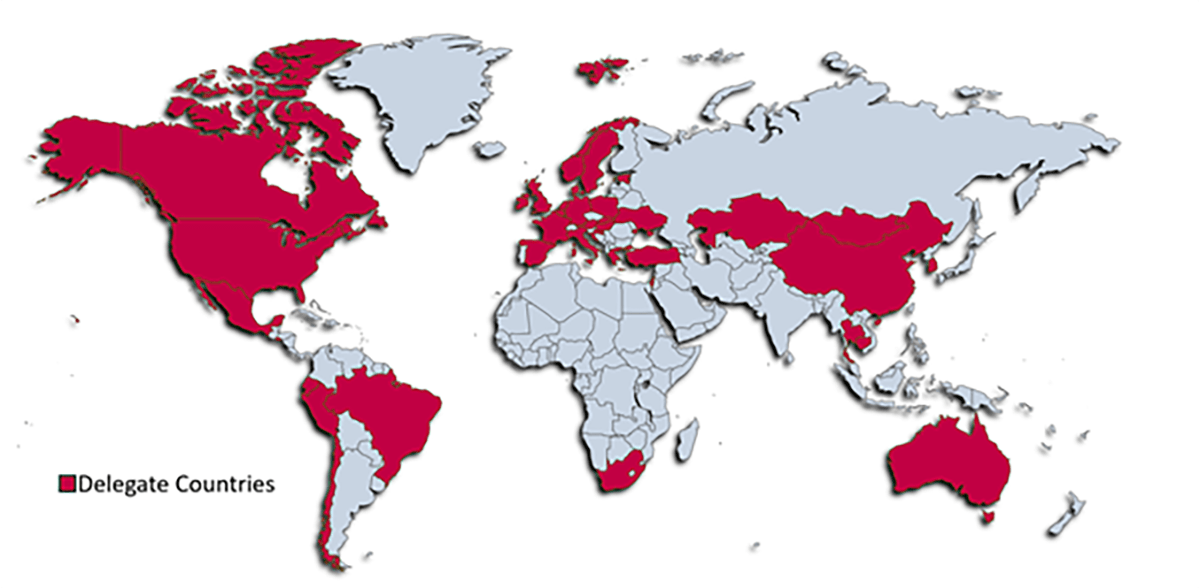

Conference attendees

Over 400 delegates attended the conference in 2025, covering all facets of credit risk and credit control.

Banks 44%

Other (consultancies, analytics, rating/data providers)40%

Educational Institutes 13%

Regulators 3%

Keynote Speakers

For those who were sadly unable to attend the event we hope to see you in 2027 for the 20th Credit Scoring & Credit Control Conference, but we are happy to share a selection of our keynote speaker presentations:

Professor Emilio Carrizosa, Professor of Statistics and Operational Research in the University of Seville (Spain) and President of the Spanish Network for Mathematics in Industry (math-in): "Raiders of the Lost Interpretability".

Professor Monica Billio, Professor of Econometrics at the Department of Economics, Ca’ Foscari University of Venice: " Network extraction and modelling".

Dr Stephen Miller, Principal Data Scientist at Equifax: " Machine Learning at the Credit Bureau: The Role of Predictive Modelling in a Regulated Landscape”.

Harriet Richards, Manager, Climate Risk, Bank of England, presented on “Measuring and mitigating climate-related financial risks using scenario analysis - a case study on residential mortgages”. We cannot provide the slides, however, you can read the related report, "Measuring climate-related financial risks using scenario analysis | Bank of England".

Sponsors

We wish to once again thank the sponsors of the Credit Scoring & Credit Control Conference XIX without whom the event would not have been such a success:

- Paragon Business Solutions - sponsor of the conference dinner at the National Museum of Scotland and prize for the best paper

- 4most - sponsor of this year’s welcome reception at the National Galleries of Scotland

- FICO - sponsor of the conference app & website

- Experian - sponsor of Wednesday’s programme

- TransUnion - sponsor of Thursday’s programme

- Revolut - sponsor of Friday’s programme

- True North Partners - sponsor of the new educational support package

- Model Risk Managers' International Association (MRMIA) - sponsor of the Model Risk Session

- ThreeCs - sponsor of the conference dinner quiz

Research

Over 100 research papers were featured exploring the most pressing issues in credit risk, such as AI and machine learning applications, fairness and algorithmic bias, the impact of the cost of living crisis, and climate change. The Best Paper Award, sponsored by Paragon, was presented Dmytro Kolechko, the CEO of Wing Bank, for his paper titled "Digital Footprint Credit Scoring Modeling".

Pre-conference workshops

A record number of delegates arrived early for this year’s pre-conference workshops:

- “Integrating Credit Risk and Finance” by Joseph L. Breeden, CEO of Deep Future Analytics LLC, and President of Model Risk Managers’ International Association

- “Multi-Modal Deep Learning in Banking: Leveraging Artificial Intelligence for Next-Generation Financial Services” by Cristián Bravo, Professor and Canada Research Chair in Banking and Insurance Analytics, Department of Statistical and Actuarial Sciences, Western University & María Óskarsdóttir, Lecturer, School of Mathematical Sciences, University of Southampton and Associate Professor, Department of Computer Science, Reykjavik University

- “How Things Work in Practice” by David B. Edelman, Founder, Caledonia Credit Consultancy

- “Practical Model Risk Management for the Credit Modeller” by Alan Forrest, Business Associate, Credit Research Centre (University of Edinburgh Business School); Board member, Model Risk Managers International Association (MRMIA.org)

Please refer to Conference papers for all available materials from the Credit Scoring & Control Conference 2025, and previous conferences.

We look forward to seeing you in 2027 (31 August- 3 September) for the 20th Credit Scoring and Credit Control Conference.